January 2021 commercial real estate prices for the New Orleans/Metairie MSA increased dramatically for the retail and multi-family lease sectors and shopping center sale sector, but prices declined in office and industrial leasing and office, retail and industrial sale sectors. Demand and supply affected each sector differently which creates opportunities for commercial real estate buyers, sellers, landlords and tenants.

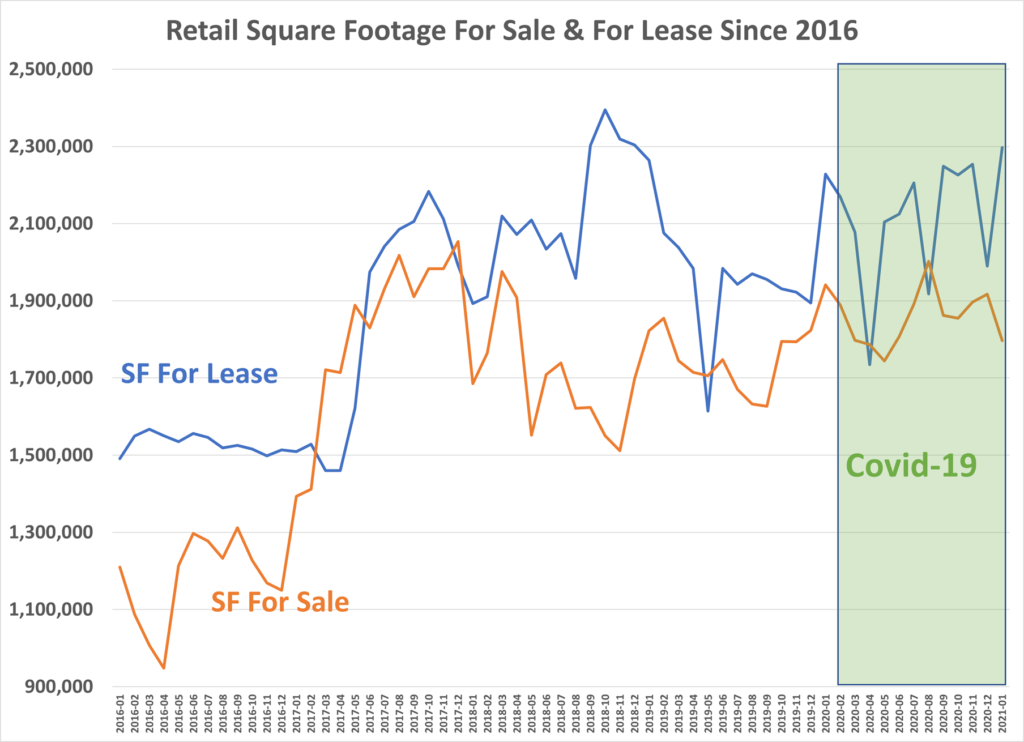

Over the last 6 months, over 500,000 square feet has been eliminated from the market for sale but 900,000 square feet added for lease. This change in supply mixed with various demand curves, causes some sectors to incur increasing prices while other sectors witness declining prices. This article examines price changes for the various categories of commercial property and looks for trends and opportunities.

Lease prices for office space in the New Orleans/Metairie Metropolitan Statistical Area averaged $17.95 per square foot, an increase of 26 cents per square foot over the last 6 months with 169 properties for lease totaling 700,000 SF (20 percent) added to the market. The new supply should push lease prices much lower.

Sale prices averaged $124/SF, a decrease of $1/SF, with only 11 properties added. There was unprecedented activity in just the last month with 20 properties leased averaging $15/SF and 11 sold averaging $151/SF.

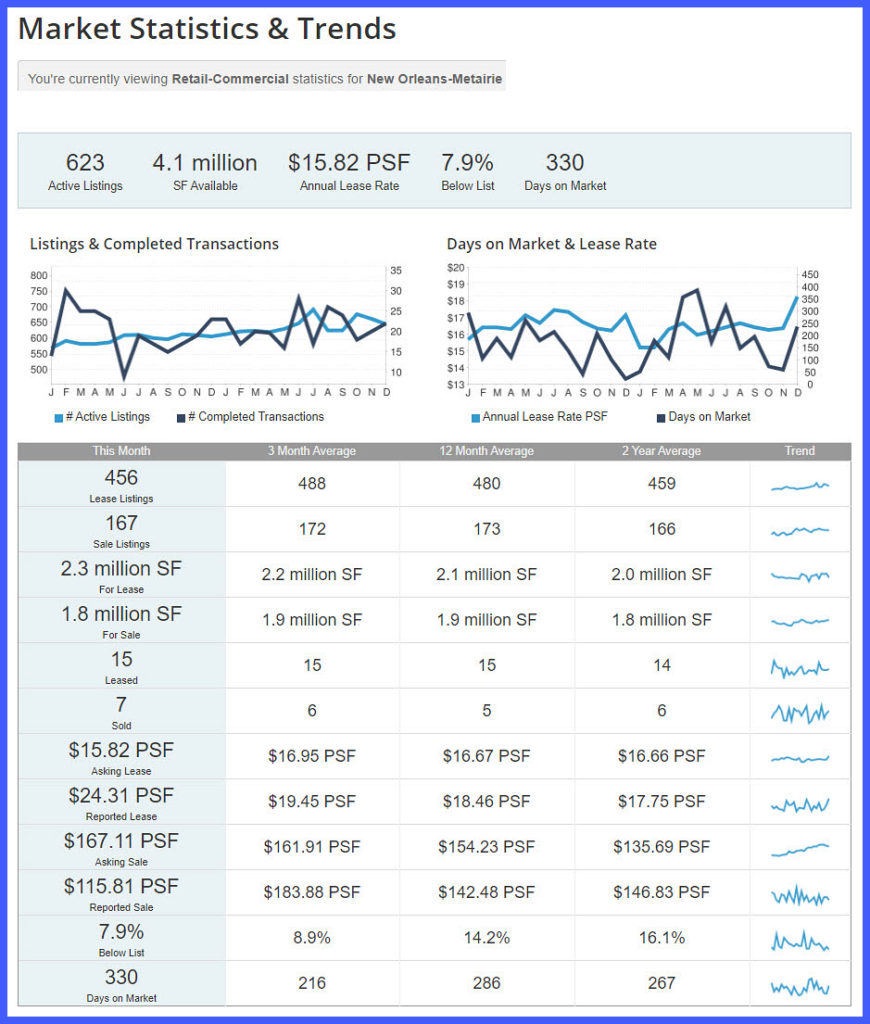

In the retail store category the last 6 months, there are 17 few properties for lease but 200,000 more square feet and 7 fewer for sale with no change in square feet. The average property is on the market 330 days and last month 15 spaces leased averaging $24/SF even though list prices were $15.82/SF, and 7 properties sold averaging $115/SF while list sale prices averaged $167/SF.

The last 6 months saw 26 more shopping center spaces for lease totaling 144,000 SF averaging $14/SF. The average lease rate increased 83 cents/SF (6 percent) and sale prices doubled from an average of $73/SF to $141/SF, due to 127,000 SF taken off the market, a 40 percent drop in supply.

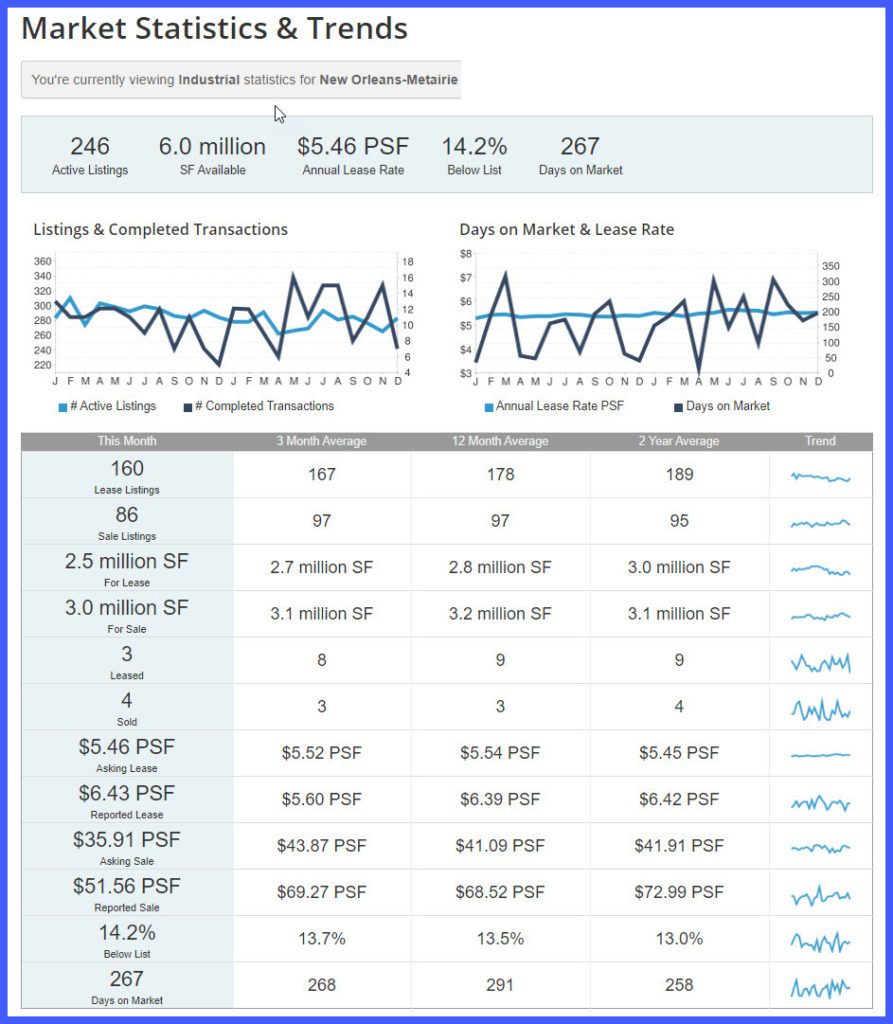

The industrial market was steady with only 13 fewer properties for lease and 10 fewer for sale. Lease rates decreased 18 cents to $5.46/SF and sale prices decreased $2/SF to $35/SF. Last month there were 3 properties leased at $6.43/SF (15% above average) and 4 high valued properties sold for $51/SF, 45% above the average price.

For comparison charts of prices, see our page Louisiana Commercial Property Price Charts For 3rd Quarter