Louisiana first encouraged the movie industry to come here in 2002, when the legislature passed the Motion Picture Tax Credit Program, but it didn’t catch on until we beefed it up in 2005, and this year the incentives are producing spectacular results. In the 63 years before the incentives were created, 52 movies were made, including the favorite Easy Rider in 1969; in the 13 years after, 295 movies were made. In 2015, we are on track to produce 36 movies, about the annual average the last 6 years.

The Motion Picture Tax Credit Program offers a 30% rebate on spending inside Louisiana, and an additional 5% for hiring Louisiana residents. Many banks and law firms broker these tax credits which can be sold to investors and used to offset Louisiana income taxes, either corporate or personal. So Tom Benson, or Shell Oil, who pay large amounts of state income taxes, can buy these tax credits for a fraction of the value, and use them to pay their taxes. Donald Trump, not so much.

The money they pay for the tax credits goes to the movie company as cash which they use to finance the movie. So it lowers the cost of the movie, which encourages them to come to Louisiana. For example, at the premier for the movie, RAY, about Ray Charles and starring Jamie Foxx, producer Taylor Hackford said he strongly considered making the movie in Canada, but switched to Louisiana because of the tax incentives.

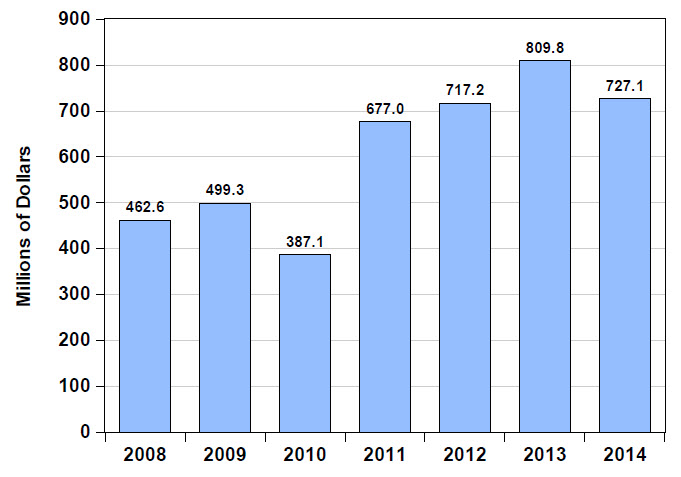

According to the Louisiana Film Entertainment Association, Louisiana is the third largest film production center outside of New York and California. Last year the film industry created 12,107 jobs averaging $60,000 annual wages and spent 776 million dollars, resulting in local and state taxes of $65 million, excluding wages to actors, producers, directors and writers.

So what did Louisiana do with this new wealth? Representative Joel Robideaux from Lafayette terminated its growth by introducing a law putting a cap on tax credits of $250 million. The law went to the governor for signature last week. To see how your legislator voted, see the legislature website vote.

| MOVIE | TYPE | MOVIE COMPANY |

| The Devil and the Deep Blue Sea | Feature Film | |

| Scream Queens | TV Series | Brightstar Fox Productions |

| Pitbulls & Parolees Season 7 | TV Series | Animal Planet |

| Ghostly Matters | MOW | G-Wave Productions |

| Beyond Deceit | Feature Film | Mike and Marty Productions |

| Nightwatch Season 2 | TV Series | 44 Blue Productions |

| Into the Badlands | TV Series | Stalwart Films |

| The Big Short | Feature Film | Plan B Productions |

| Keanu | Feature Film | Chime Productions |

| Carter & June | Feature Film | Spencer Rabbit LLC |

| Rodeo & Juliet | Feature Film | |

| When the Bough Breaks | Feature Film | Screen Gems |

| Quarry | TV Series | HBO/Cinemax |

| Zoo | TV Series | CBS Television |

| The Long Night | Feature Film | Lionsgate/Di Bonaventura Pictures |

| Elvis & Nixon | Feature Film | HW Productions |

| The Free State of Jones | Feature Film | Larger Than Life Productions |

| Chasing Moksha | Feature Film | Independent |

| NOLA Circus | Feature Film | Independent |

| The D Train | Feature Film | Ealing Studios |

| Our Brand is Crisis | Feature Film | Warner Bros. |

| Midnight Special | Feature Film | Warner Bros. |

| Mississippi Grind | Feature Film | Sycamore Pictures |

| Cat Run 2 | Feature Film | Independent |

| Get Hard | Feature Film | Warner Bros. |

| Jurassic World (Ebb Tide) | Feature Film | Universal |

| Terminator Genisys | Feature Film | Paramount/Skydance |

| The Best of Me | Feature Film | Relativity Films |

| American Ultra | Feature Film | Likely Story |

| Pitbulls & Parolees Season 6 | TV Series | Animal Planet |

| NCIS: New Orleans (Pilot) | TV Pilot | CBS |

| Hot Pursuit (Don’t Mess with Texas) | Feature Film | Warner Bros. |

| American Horror Story: Freak Show | TV Series | Fox |

| Black Ink: New Orleans | TV Series | VH1 |

| Saints & Sinners (Pilot) | TV Pilot | A&E |

| Geostorm | Feature Film | Skydance/Warner Bros |

| Mind Puppets | Feature Film | Itaca Films |

| Adam Divine’s House Party | TV Episode | Bacon Bar Productions |

| The Runner | Feature Film | Paper Street Films |

| Trumbo | Feature Film | Groundswell Productions |

| The American Project | Feature Film | Independent |

| The Whole Truth | Feature Film | Likely Story |

| NCIS: New Orleans Season 1 | TV Series | CBS |

| Banshee | TV Episode | HBO/Cinemax |

| Astronaut Wives Club | TV Series | ABC Television |

| Man Down | Feature Film | Mpower Pictures |

| Mr. Right | Feature Film | Amezia Productions |

| Valencia | Feature Film | Bad Robot |

| Nightwatch | TV Series | A&E |

| Kidnap | Feature Film | Relativity Studios |

| Saints & Sinners | TV Series | A&E |

| Daddy’s Home | Feature Film | Paramount |

| Abattoir (Crone) | Feature Film | Radical Studios |

| The Magicians | TV Pilot | NBC Universal |

| Joe Dirt 2 | Feature Film | Sony/Crackle |

| Kickboxer | Feature Film |

| Cat Run 2 | TV Episode | KOG Productions |

| Return to Sender | Feature Film | HW Productions |

| Una Vida | Feature Film | Independent |

| Grudge Match | Feature Film | Warner Bros. |

| True Detective | TV Series | HBO Entertainment |

| Remember Sunday | MOW | Hallmark Channel |

| Pitbulls & Parolees Season 5 | TV Series | Animal Planet |

| Now You See Me Reshoots | Feature Film | Summit Entertainment |

| Heat | Feature Film | Current Entertainment |

| When The Game Stands Tall | Feature Film | Mandalay/Sony |

| The Originals | TV Pilot | Warner Bros. |

| Devil’s Due | Feature Film | Fox |

| Oxygen | TV Pilot | CBS Studios |

| Second Sight | TV Pilot | CBS Studios |

| Reckless | TV Pilot | ABC Studios |

| American Horror Story: Coven | TV Series | Ryan Murphy Television |

| Home Sweet Hell | Feature Film | Darko Entertainment |

| Hot Tub Time Machine 2 | Feature Film | MGM/Spyglass |

| Dawn of the Planet of the Apes | Feature Film | 20th Century Fox |

| American Heist | Feature Film | Glacier Films |

| Occult | TV Pilot | ABC Studios |

| Top Chef Season 11 | TV Series | Bravo |

| Dermaphoria | Feature Film | Upload Films |

| Black or White | Feature Film | Sunlight Productions |

| Star-Crossed | TV Series | CBS Television Studios |

| Focus | Feature Film | Warner Bros. |

| Ravenswood | TV Series | CBS Studios |

| Self/less | Feature Film | Endgame Entertainment |

| Maggie | Feature Film | Gold Star Films |

| 22 Jump Street | Feature Film | Sony |

| 99 Homes | Feature Film | Noruz Films |

| Refugio | Feature Film | Itaca Films |

| Kidnapping Mr. Heineken | Feature Film | Informant Films |

For more information on what drives our economy, click on these articles:

Which Industry Drives Louisiana's Economy?

Economic Driver's of New Orleans' Commercial Real Estate Industry

Major Industries of the 10 Parish New Orleans Market

Sources: Louisiana Economic Development, Forbes, ABC, Economic Impact of Louisiana's Tax Credit Program, WWNO, Times-Picayune, Mayor's Office of Cultural Economy

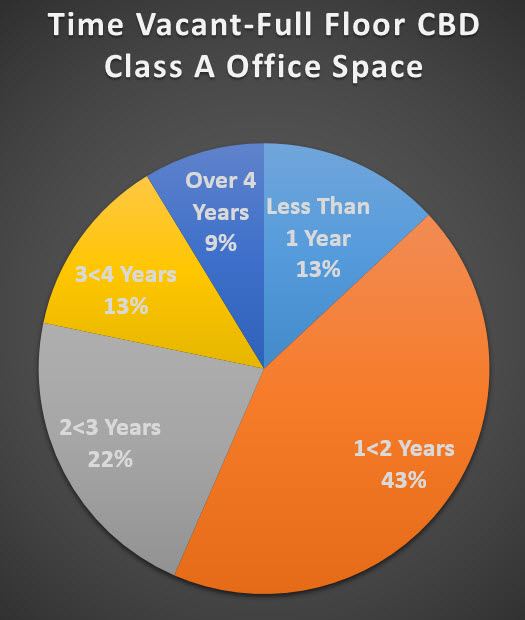

You might think taking 2 years to lease vacant office space is an outlier, an anomaly, or that something's just wrong: like a building sitting on an earthquake fault; however, it's just par for course for downtown New Orleans' finest office towers where 78% of full floor offices have sat vacant for over one year, and 35% have sat for over 2 years, and 13% for over 4 years. And that's just vacant time to date.

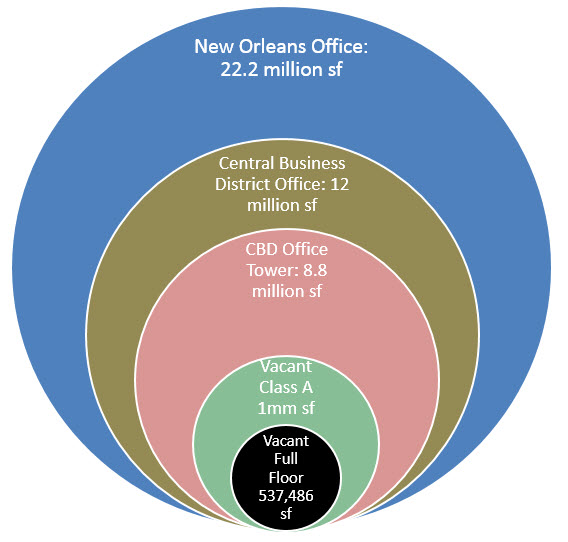

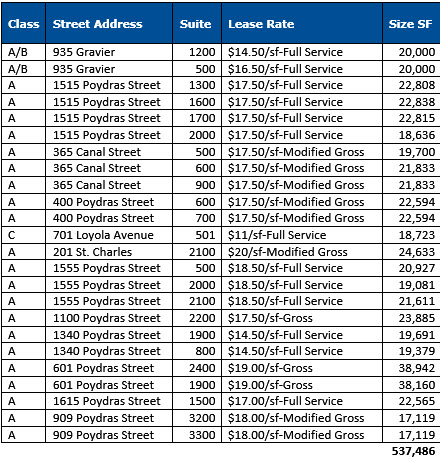

Let's step back and get an idea of the office market in New Orleans. There are 22.2 million square feet of rentable office space in the New Orleans market, with 70% of office space in buildings under 50,000 square feet. Of this, 12 million square feet of office space is in the Central Business District and, of this, 8.8 million rentable square feet comprises the CBD Class A Office Tower market and 1.6 million rentable square feet is Class B office space. Of this, approximately 1 million square feet of Class A office space is for lease and, of this, approximately 50% is full floor space. Full floors, if leased to a single tenant, only interest companies with at least 50 employees, which are in smaller supply than those with 5 to 10 employees, resulting in a longer lead time to lease larger office spaces. However, prices have not responded to a lack of supply since ownership of New Orleans Class A off tower buildings is an oligopoly. CBD Class A base rents have averaged $18 per square foot the last few years, resulting in many spaces having gone unleased for several years. Our forecast is for this vacancy rate to remain the same until prices adjust.

There are 12 Class A buildings in the New Orleans CBD with 24 Class A full floor spaces priced between $14.50 per square foot to $20.00 per square foot, and Class B/C office space available at $11 per square foot. Total full floor CBD office space is 537,486 square feet, and since our forecast is for only 100,000 square feet to be absorbed in 2015, it will take 5 years to lease the current supply. Owners of high vacancy office buildings will need to consider selling their property to redeploy assets to better performing categories, or reduce prices dramatically. The present value of $18 rent 5 years from now is $13.45 (assuming 6% opportunity cost), meaning that leasing space now at $13.45 PSF would be the same as receiving $18 PSF in 5 years.

Large full floor office spaces have languished on the market but the smaller size office spaces are in big demand because of the shift that began decades ago in our economy away from oil and gas to tourism. It all started when we hosted a party and ended up with the 5th largest building in America. The party was the 1984 World's Fair and the building was the convention center. Started by mayor Dutch Morial, the driver of the New Orleans economy has grown to 3,000,000 square feet since then.

But there are other economic drivers such as digital media and movie production which do not yet have as much of an impact but are growing much faster. One of the latest economic drivers is the influx of entrepreneurs, pulled to New Orleans for its culture and tax incentives for corporations to employ here. These are the tax incentives which were just capped last Thursday, in a bill sponsored by Rep. Joel Robideaux from Lafayette.

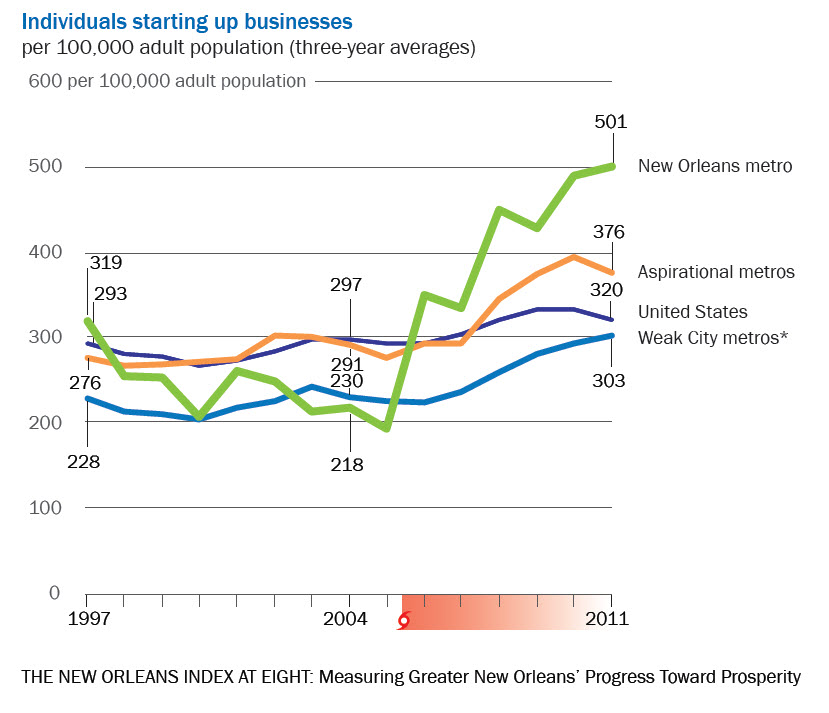

The influx of entrepreneurs is verified by research from The Data Center in their report, The New Orleans Index at Eight: Measuring Greater New Orleans’ Progress Toward Prosperity, which shows a dramatic increase in start-up businesses in the New Orleans area.

Start-ups tend to require smaller office space and are hesitant to sign long term leases, leading to demand for executive suites which offer month-to-month leasing including secretarial support, conference rooms and locations in Class A office space. Our forecast is for smaller office spaces to see an increase in demand while larger office spaces languish, dragging down performance which causes office buildings to come on the market.

In summary, the large Class A office spaces are sitting on the market and will continue to sit until prices adjust, but the smaller office spaces are filling the void in demand for new business start-ups. Where one door closes, another one opens.

For more information on tax credits encouraging growth, click on our article:

14 Incentives Leading New Businesses To New Orleans

Sources: LoopNet. LACDB, Emporis databases. GNO, Inc, The Data Center.

It is a 100 year old well known historic-looking warehouse, steeped in the history of New Orleans as a port city, and the owners have recently hired Louisiana Commercial Realty to market nationwide the 39,042 square foot brick building for lease. The building has been family owned for almost half a century, and recently two family members bought out the remaining family, made improvements and began leasing the building themselves to a movie studio and a metals company for storage.

It is a 100 year old well known historic-looking warehouse, steeped in the history of New Orleans as a port city, and the owners have recently hired Louisiana Commercial Realty to market nationwide the 39,042 square foot brick building for lease. The building has been family owned for almost half a century, and recently two family members bought out the remaining family, made improvements and began leasing the building themselves to a movie studio and a metals company for storage.

The owners are bringing in commercial real estate leasing broker Robert Hand, managing director of Sperry Van Ness | Southeastern Commercial Realty, who says, "It is a terrific building in a great location. It has been well maintained and offers a raised concrete slab foundation, brick exterior, metal roof, 10 loading docks and a clear span interior with skylights for great lighting. It has a great location: just one half mile from I-10 at the First Street Wharf entrance."

The building is for lease at $4.25 per square foot, net of expenses such as taxes and insurance which are estimated at 90 cents per square foot, and is located on Tchoupitoulas and Market Street, opposite the Market Street Power Plant which is expected to be redeveloped as a mixed use retail and hotel center.

Tchoupitoulas Street is also a major trucking throughway that serves the Port of New Orleans, which has the world’s longest wharf: a 2 mile conglomerate of 16 wharves, accommodating 15 vessels at one time. The Port is the only deep-water port in the United States connecting to six major railroads, making it a cost-effective destination for shipping. The nearby First Street Wharf has a 1,275 foot berth primarily handling breakbulk cargo and is operated by Empire Stevedoring.

Since the area is zoned mixed use, MU-A, a wide variety of businesses are able to utilize the space, including: