Every year, on average, the Corps of Engineers allows 20,000 acres of wetlands to be impacted by developments but at the same time they require 56,000 acres of wetlands to be restored. This article explores how developers protect our wetlands under a program administered by the US Army Corps of Engineers by purchasing mitigation bank credits which offset the impact a development might have on wetlands.

Since New Orleans is technically under sea level, you would expect many real estate developers to be eventually confronted with wetlands on their property, which the Environmental Protection Agency defines as “an area that is regularly saturated by surface water or groundwater and is characterized by a prevalence of vegetation that is adapted for life in saturated soil conditions”. Although these areas make up a very small percentage of the total land found in the United States, Southern Louisiana contains 40 - 45% of the wetlands found in the lower 48 states. This is because Louisiana is the drainage gateway to the Gulf of Mexico for the Lower Mississippi Regional Watershed which drains more than 24 million acres in seven states from southern Illinois to the Gulf of Mexico.

Mitigation Banking

Compensatory mitigation for unavoidable wetland impacts may be accomplished through three distinct mechanisms:

• Permittee-Responsible Mitigation: Restoration, establishment, enhancement or preservation of wetlands undertaken by a permittee in order to compensate for wetland impacts resulting from a specific project. The permittee performs the mitigation after the permit is issued and is ultimately responsible for implementation and success of the mitigation. Permittee-responsible mitigation may occur at the site of the permitted impacts or at an off-site location within the same watershed.

• Mitigation Banking: A wetlands mitigation bank is a wetland area that has been restored, established, enhanced or preserved, which is then set aside to compensate for future conversions of wetlands for development activities. Permittees, upon approval of regulatory agencies, can purchase credits from a mitigation bank to meet their requirements for compensatory mitigation. The value of these “credits” is determined by quantifying the wetland functions or acres restored or created. The bank sponsor is ultimately responsible for the success of the project. Mitigation banking is performed "off-site," meaning it is at a location not on or immediately adjacent to the site of impacts, but within the same watershed. Federal regulations establish a flexible preference for using credits from a mitigation bank over the other compensation mechanisms.

• In-Lieu Fee Mitigation: Mitigation that occurs when a permittee provides funds to an in-lieu-fee sponsor (a public agency or non-profit organization). Usually, the sponsor collects funds from multiple permittees in order to pool the financial resources necessary to build and maintain the mitigation site. The in-lieu fee sponsor is responsible for the success of the mitigation. Like banking, in-lieu fee mitigation is also "off-site," but unlike mitigation banking, it typically occurs after the permitted impacts.

Here’s how mitigation works in real estate development. Let’s say a private developer is building a subdivision on 900 acres of land, of which 300 acres has been declared wetlands by the U.S. Department of Army under the Corps of Engineers. Once federal and state regulatory agencies have agreed that the developer cannot avoid or even minimize the effect on those acres, the developer must compensate – hence, the word mitigation – for the wetlands’ loss by purchasing credits in a mitigation bank.

The mitigation bank is the area that has been restored-not a bank as we know it- and has four distinct components:

1. The bank site: the physical acreage restored, established, enhanced, or preserved;

2. The bank instrument: the formal agreement between the bank owners and regulators establishing liability, performance standards, management and monitoring requirements, and the terms of bank credit approval;

3. The Interagency Review Team (IRT): the interagency team that provides regulatory review, approval, and oversight of the bank; and

4. The service area: the geographic area in which permitted impacts can be compensated for at a given bank.

Before a bank can be permitted, and approved for wetland credit sales, federal and state government regulatory agencies form a Mitigation Banking Review Team (MBRT) that must approve plans for building the bank, from the hydrological and planting design to maintenance and monitoring arrangements. The MBRT also approves the number of mitigation credits that may be earned by the banker.

A developer can buy credits only if they have applied to the federal and/or state agency responsible for wetland permitting, and have provided adequate justification of a need to impact wetlands on their development. Mitigation regulations recommend that the impact and compensation be located in the same watershed and that the impact and mitigation be the same habitat, of similar ecological value or ecologically preferable.

In-Lieu Fee Mitigation

A permit applicant may make a payment to an in-lieu fee program that will conduct wetland, stream or other aquatic resource restoration activities. In-lieu fee programs, as shown in Chart One, are generally administered by government agencies or non-profit organizations that have established an agreement with the regulatory agencies to use in-lieu fee payments collected from permit applicants.

Usually a non-profit organization acts as an intermediary to restore, enhance, create and preserve wetlands and assumes responsibility for their long-term maintenance, earning mitigation credits for their efforts. Non-profits can then sell these mitigation credits to developers who have a permit who must compensate for having impacted wetlands. The sale of wetland credits legally transfers the liability for wetland mitigation from the permittee to the wetland banker.

New Rules

In 2008, the U.S. Army Corps of Engineers adopted new rules that dramatically changed its approach to mitigation under Section 404 of the Clean Water Act, which regulates fill in wetlands and other waters of the United States. The new rules adopt a mitigation hierarchy that moves away from the prior preference for onsite mitigation in favor of mitigation banks and watershed-based mitigation programs. If you wish to obtain a permit to impact wetlands, you must first minimize impacts, and then compensate for unavoidable impacts. The basis for the new rule is that despite progress over the last two decades, there are still gaps in the science of restoration ecology.

The new rule state a permittee must have mitigation plans which include the following:

| *objectives |

*a mitigation work plan |

| *site selection criteria |

*a maintenance plan |

| *baseline information (for impact sites) |

*credit determination methodology |

| * performance standards |

*a long-term management plan |

| *site conservation easements |

*monitoring requirements |

| *financial assurances |

|

Source: 1 Federal Register, Guidance for Establishment, Use and Operation of Mitigation Banks, November 28, 1995

Text and images are copyrighted. Contact author for permission.

Louisiana Commercial Realty announced today they were hired to market the 16,000 square foot two-story office building at 739 South Clark Street, near Tulane Avenue and Jefferson Davis Parkway in New Orleans. The building was completely renovated by Ellis Construction and features a unique design including open area for collaborative work flow, cypress flooring, ample controlled parking and large windows allowing light to flow throughout the space.

Tulane Avenue in recent years has experienced a rebirth with more new multi-million dollar developments than any other area of New Orleans, including several large apartment buildings, retail centers, retirement facilities, and the largest hospital development in the United States: the Veterans Administration and the LSU hospitals.

739 south clark

Robert Hand, president of Louisiana Commercial Realty said, ” This is a very special renovation; there is no other building like this in New Orleans. Ellis Construction put real heart into this spectacular renovation, and we think the space is perfect for a growing architectural firm, software design firm, or digital media company. The building is for sale at $2,050,000 and the 2nd floor is also for lease."

Tulane Avenue has witnessed over $1 billion dollars in developments since Hurricane Katrina. Louisiana Commercial Realty has been instrumental in almost all of the Tulane Avenue developments, representing the Domain Company in their development of the 228 unit Crescent Club Apartments, the 72 unit Meridian Apartments, the 183 unit Preserve Apartments, the 18,000 square foot Shops at Crescent Club Retail Center and representing Provident Realty in their development of the 250 unit Marquis Apartments.

More information is available by downloading the 739 South Clark marketing presentation.

Technology has taken a giant leap forward in the last few years by expanding the traditional tool of demographic research into an analysis of lifestyles and consumer spending behavior. The old-school strategy was to look at population count, income, and age to determine a good location for a business. But new-school tools such as leakage factor, retail gap, and Tapestry lifestyle analyses take decision making to a higher level and reduce the risk of failure.

Technology has taken a giant leap forward in the last few years by expanding the traditional tool of demographic research into an analysis of lifestyles and consumer spending behavior. The old-school strategy was to look at population count, income, and age to determine a good location for a business. But new-school tools such as leakage factor, retail gap, and Tapestry lifestyle analyses take decision making to a higher level and reduce the risk of failure.

This article examines how these new technologies can help commercial real estate professionals make better real estate decisions. We examine an actual 10 acre tract in New Orleans, utilizing the latest technology of the Certified Commercial Investment Member database to generate sophisticated site analysis information on the best use by examining the lifestyle of the residents in the area — and how they spend their money — to determine what retail businesses were needed.

Drive Times

Typically the target-area population analysis looks at demographics within a radius of 3 miles, 5 miles, and 10 miles. However, a better approach is drive-time analysis, which provides more-useful information when there are natural boundaries to an area: For example, north of New Orleans is Lake Pontchartrain and east of New Orleans is a wetlands area and wildlife preserve.

Within the drive times, knowing the population density, per capita and household income, home ownership, and age brackets helps to determine which retailers might thrive: Brooks Brothers or Dollar General? For multifamily, we can examine how many people rent and are in their 20s, the prime apartment renting age. For example, in the 5- and 10-minute drive times from the target 10-acre site, future growth trends show increases in household formation and income. (See Table 1: Demographic Summary.)

Traffic counts also provide useful data, particularly for retail site analysis. The 2008 traffic study by the Louisiana Department of Transportation showed Interstate 10 traffic in New Orleans East at 34,000 cars per day, and the 2010 estimate from Datametrix (www.stdb.com) is 30,000 cars per day.

Demographics – New School

Market Potential. The Market Potential Index measures the relative likelihood of households in the specified trade area exhibiting certain purchasing patterns compared to the United States as a whole. An MPI of 100 represents the U.S. average; a higher number indicates a higher propensity to spend in that category, compared to the national average. (See Table 2: Market Potential Index.)

Two conclusions can be drawn from consumer spending data. First, the MPI exceeds 100 on seafood and chicken/turkey in both the 5- and 10-minute drive time areas, revealing a higher than average propensity to spend on these items. Second, the population is high enough to support at least four supermarkets, using the market assumption that a 50,000-square-foot supermarket needs approximately 8,000 residents.

We can zero in on how much money residents spend annually in specific categories. For example, within a 5-minute drive time of the site, the total amount of money spent on food at home exceeds $39 million and within a 10-minute drive time exceeds $111 million. We also can drill down to determine what types of items a supermarket could sell to have a competitive advantage. For example, within a 10-minute drive time, $38 million was spent on “snacks and other food at home.” (See Table 3: Specific Spending.)

Retail Opportunity. Using industries categorized by North American Industry Classification System, or NAICS, codes, we can pinpoint where demand exceeds supply and shows a need for a business to fill a void. We determine supply by estimating sales to consumers by establishments, while excluding sales to businesses. We forecast demand, or retail potential, by estimating the expected amount spent by consumers at retail establishments.

The gap between demand and supply is called the leakage factor, which presents a snapshot of retail opportunity. This is a measure of the relationship between supply and demand that ranges from +100 (total leakage) to -100 (total surplus). A positive value represents “leakage” of retail opportunity outside the trade area. A negative value represents a surplus of retail sales, a market where customers are drawn in from outside the trade area.

NAICS represents one of the most profound changes for statistical programs focusing on emerging economic activities. The system groups establishments into industries based on their primary activity. NAICS moves down in detail from sector to subsector to group then to industry. This is an improvement over the previous method, the 1987 Standard Industrial Classification, or SIC, system.

The highest leakage factor shows a need for miscellaneous retailers such as florists, office supply, and pet shops; furniture; sporting goods; clothing; and food stores. (See Table 4: Leakage/Surplus by Subsector.)

The leakage factor shows what businesses are needed, by the percent that demand exceeds supply and the dollar amount of the unfulfilled demand, which can forecast sales for a business coming into the area. Retail Gap Analysis represents the difference between retail potential and retail sales: Industry groups with the largest retail gap in the target area are grocery and food and beverage. (See Table 5.)

Zip Code. Retail Marketplace Reports are available by theme, such as grocery store sales, and can drill down to county, city, zip, census tract, and block group, the smallest unit of measurement of census data. Themes can get very specific, even down to a map of the population that used aluminum foil in the past six months. We searched for grocery store sales by zip codes south and west of the target area that are above $28 million; since there is only one Winn-Dixie store in that area, we know the market will bear additional stores. We can use information on expected sales to right-size building square footage and land area.

Tapestry Reports. Tapestry identifies neighborhood segments and describes the socioeconomic quality of the immediate neighborhood. The index is a comparison of the percent of households or population in the area, by Tapestry segment, to the percent of U.S. households or population by segment. An index of 100 is the U.S. average.

The top two Tapestry segments in the target area are Family Foundations and Metro City Edge. These segments include lifestyle traits such as playing basketball and watching courtroom TV, so we can tailor our advertising around that media rather than newsprint. (See Table 6: Top 10 Tapestry Segments.)

Our use of technology has delivered important information for determining the best businesses for the target 10-acre site while reducing risk of business failure. We have progressed from simply knowing the population count, age, and income to knowing detailed information about who lives in the target area, how they spend their money, and what businesses are missing that could satisfy that demand. We have been able to conclude the target area has the highest unfulfilled demand for furniture, sporting goods, clothing, and food stores, and we have been able to forecast the total sales of a future grocery store and can plan our capital expenses such as store size accordingly. We know what makes the nearby residents unique and where they spend more of their money compared to the average consumer, so we also can lower our inventory costs by stocking the goods with the highest demand. We also can reduce our advertising costs by targeting the media that our customers will use.

These new-school tools are available to everyone facing a real estate decision, not just the Walmarts of the world.

Read the original publication in CCIM magazine here.

Two out of three ain't bad. The percent of new business start-ups since Katrina has exploded, far outpacing the national average, but the population has continued its shift out of Orleans Parish and government is still the highest job giver. This article examines where the jobs are in the 10 parish region, how we are more productive than the US as a whole, how jobs are leaving Orleans Parish and where they are going.

Two out of three ain't bad. The percent of new business start-ups since Katrina has exploded, far outpacing the national average, but the population has continued its shift out of Orleans Parish and government is still the highest job giver. This article examines where the jobs are in the 10 parish region, how we are more productive than the US as a whole, how jobs are leaving Orleans Parish and where they are going.

10 Parish Region

The New Orleans MSA ( Metropolitan Statistical Area) refers to the 7 parish area surrounding New Orleans. A MSA is an area exceeding 50,000 population with a high degree of similarity in social and economic traits. The 10 parish region includes St. James, Tangipahoa & Washington parishes since their economic traits are interwoven.

Jobs By Sector

job chart

Since 2010, four sectors have lost jobs: manufacturing, oil, government and administration services, but government is still the major employer in the 10 parish region around New Orleans with 17% of the nonfarm jobs, followed by wholesale and retail trade at 15% and hospitality at 13%.

Job Distribution

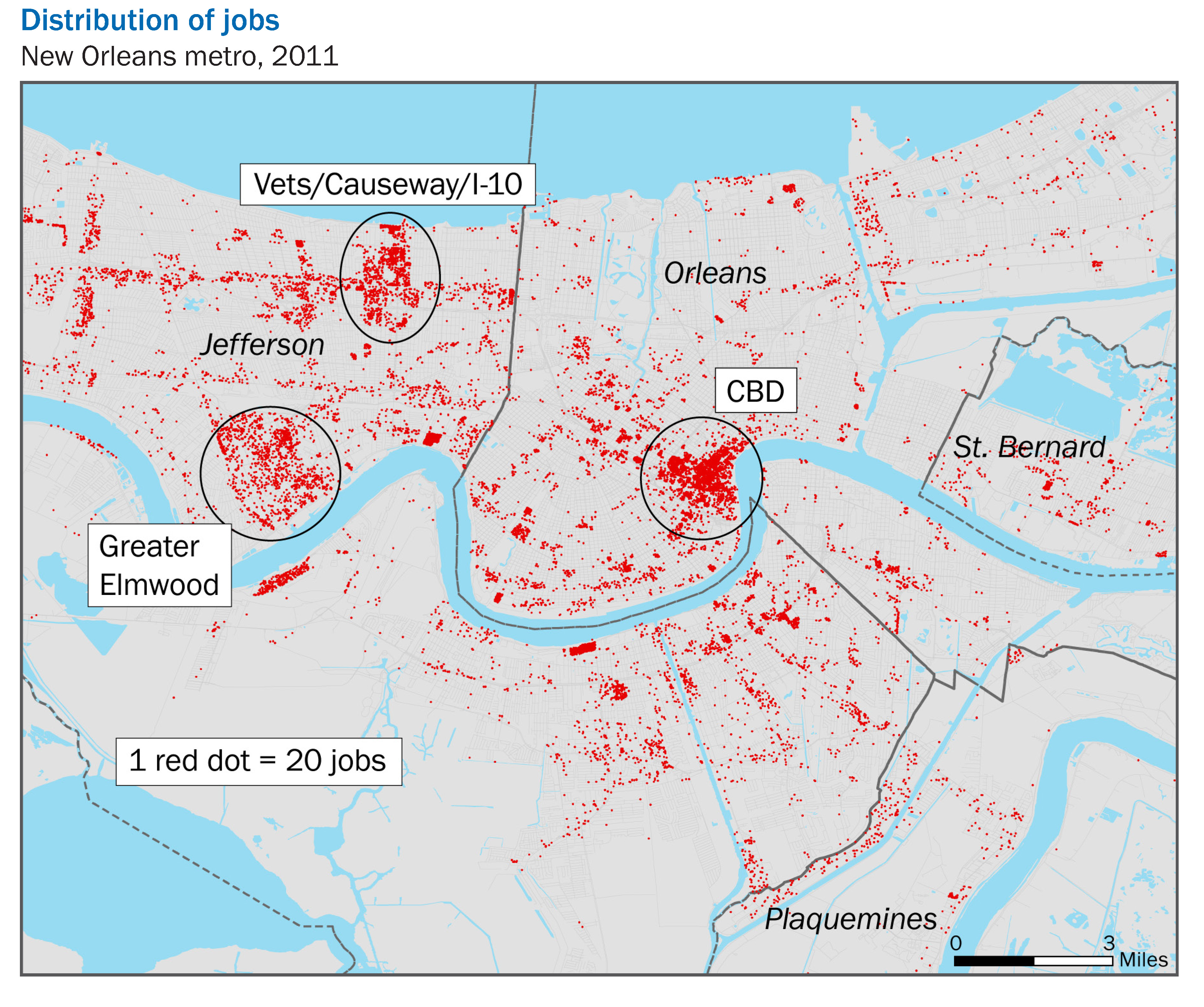

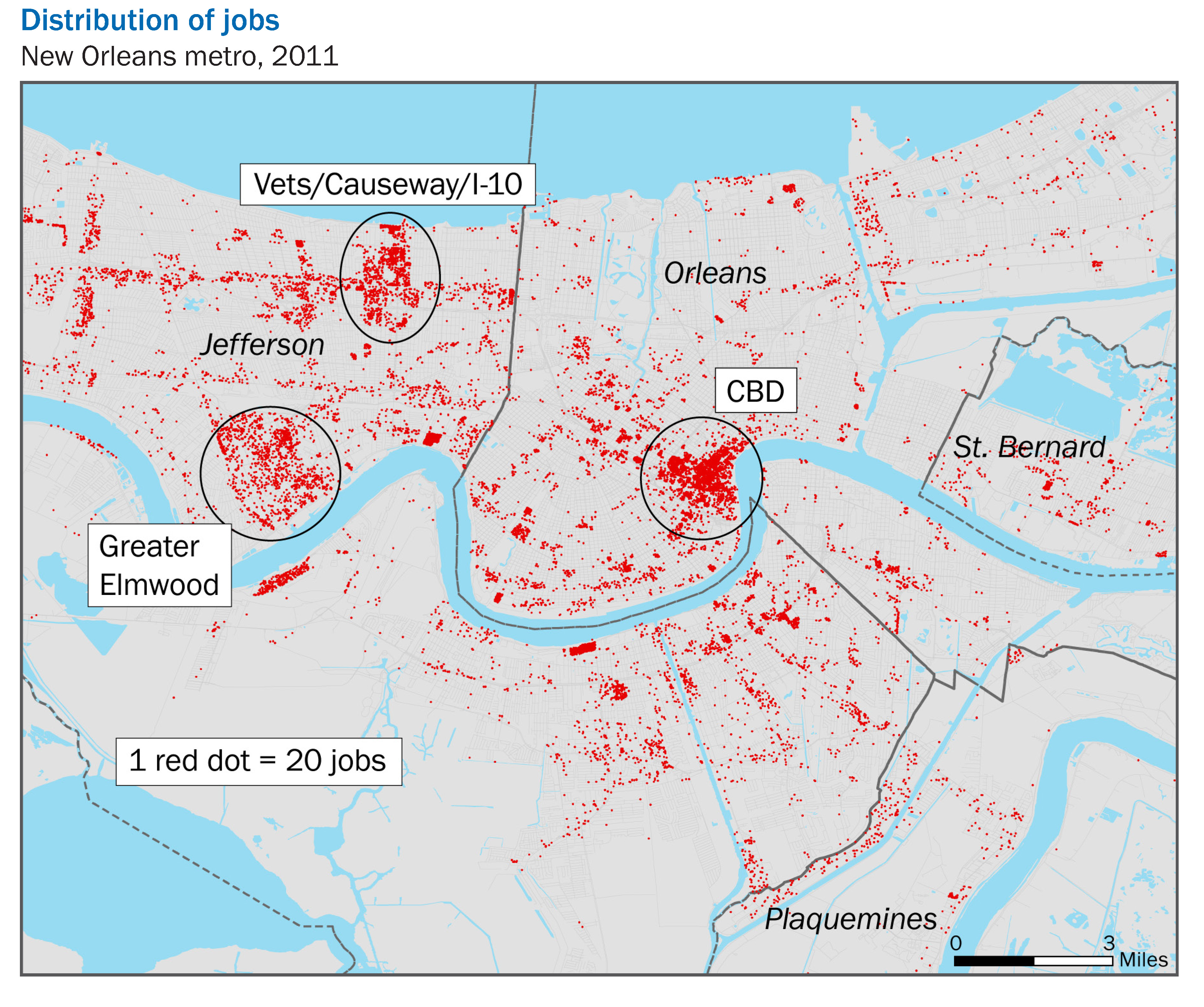

- job distribution

Most of the jobs in Orleans and Jefferson Parish fall into three areas: Downtown, Elmwood Shopping Center and Lakeside Shopping Center. Notice the blank area in New Orleans East.

New Orleans Metro Jobs By Parish

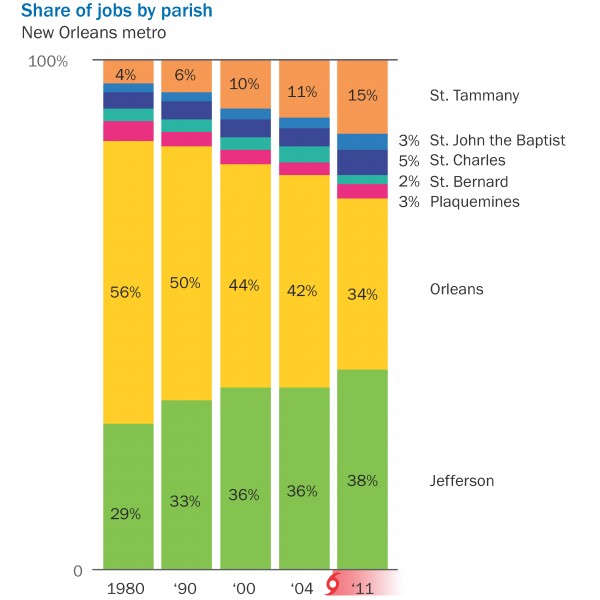

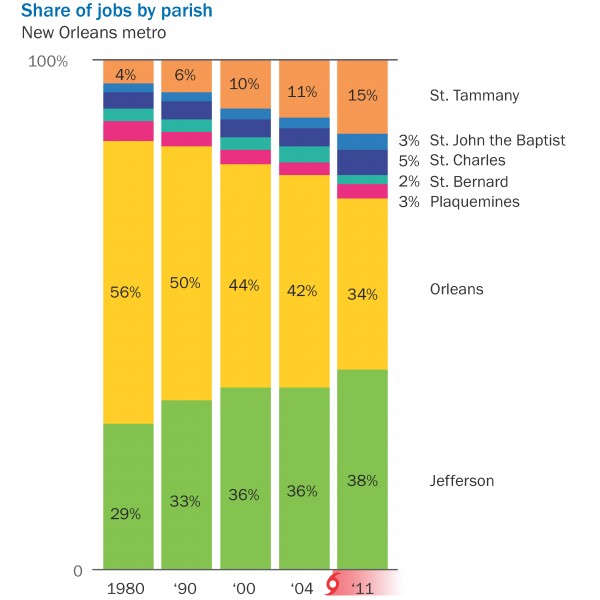

jobs by parish

Jobs have been leaving Orleans Parish since 1980. Neither Dutch, Sidney, Marc, C. Ray or Mitch could make any difference. The jobs went to Jefferson Parish and St. Tammany. Looking at the rate of change, Orleans Parish lost 39% of its market share, Jefferson Parish gained 31% of the market share, and St. Tammany gained 275% market share. Job growth is a strategic driver because it leads to housing booms, new demand for office space, new warehouses to store the goods that industry produces and new retailers to sell to the new consumers.

Productivity

productivity

Gross metro product (GMP) measures the average value of goods & services produced by each job in the region. Since 1980, productivity in the New Orleans metro area rose 24%, but the US productivity during the same time period rose 57%. More recently though, the data show a change in trend: since the 2008 recession, productivity has increased far more than the national average.

New Business Start-Ups

New businesses fled the New Orleans metropolitan area for the decade prior to Hurricane Katrina, but then things changed: existing residents decided after Katrina to start their own businesses and the influx of new residents to the area to help rebuild it led lots to stay and open their own business. The percent of new businesses due to Katrina more than doubled, which far exceeded the national trend.

Sources: Bureau of Labor, The Data Center, GNO Inc, LED

For more information on demographics trends, see our article on Louisiana's Economic Drivers.

Louisiana Commercial Realty announced today they were hired to market the 69,000 square foot tract of land at 5550 Crowder Boulevard for GTE Financial. Robert Hand, president of Louisiana Commercial Realty said, " This tract of land is a great opportunity to bring retail businesses to an underserved market. Our research shows within a 5 minute drive time there is a population of 24,000 with an average household income of $48,000, and there is a real need for businesses to come into the area and provides goods and services to these residents. There are three main businesses that are needed: Motor Vehicle, General Merchandise and Restaurants. Our research shows these businesses could have annual sales exceeding $20 million dollars."

Louisiana Commercial Realty announced today they were hired to market the 69,000 square foot tract of land at 5550 Crowder Boulevard for GTE Financial. Robert Hand, president of Louisiana Commercial Realty said, " This tract of land is a great opportunity to bring retail businesses to an underserved market. Our research shows within a 5 minute drive time there is a population of 24,000 with an average household income of $48,000, and there is a real need for businesses to come into the area and provides goods and services to these residents. There are three main businesses that are needed: Motor Vehicle, General Merchandise and Restaurants. Our research shows these businesses could have annual sales exceeding $20 million dollars."

site plan

The area is replete with new developments, including:

- New Walgreens at Crowder & Lake Forest Boulevard.

- New Dorsey Retail Center on Crowder with tenants Pizza Hut & Planet Fitness.

- New 500,000 Wal-Mart on Bullard.

- Methodist Hospital on Lake Forest & Read Road in operation.

- New Dollar General on Crowder.

Hand says, "With a resurgence of new businesses flooding the area, the quality of life for residents goes up which encourages more residents to move into the area. The Crowder area has the most affordable housing for people looking to build their life. Luxurious homes near the country club are priced around $250,000 and two-bedroom apartments are priced around $850 per month. It's a great place to get started."

Within a 5 minute drive time, the population, according to the 2010 Census, was 20,733 and is forecasted to grow to 29,217 by 2019. This growth rate exceeds 3.5% annually, which is 4 times higher than the average US population growth rate.

Hand says more information is available on the available property at LoopNet.com.

If you want to see Louisiana grow, which jobs would you prefer to bring in: oil or tourism? One of these two top industries delivers twice as many jobs but has one-third of the wages. This article examines jobs and wages, defining what is called Export Jobs which in the long run determine our economic future.

If you want to see Louisiana grow, which jobs would you prefer to bring in: oil or tourism? One of these two top industries delivers twice as many jobs but has one-third of the wages. This article examines jobs and wages, defining what is called Export Jobs which in the long run determine our economic future.

Mardi Gras is a perfect example of the strength of our economy to attract people who spend money on hotel rooms, taxis, car rentals, dining out, the latest fashions, site seeing, voodoo dolls and a host of other unique experiences found only in our nearly 300 year old city. But there is a bigger picture; it's called export jobs. These are the jobs that serve customers outside the region, as opposed to jobs that serve local customers. The reason we define export jobs is because if you have none, your economy is confined to growth of the region. Without export jobs, you can grow no more than the average, which today is around 2 to 3% annually. With export jobs, you have specialized industries that attract jobs from other regions that are void of those industries, resulting in faster than average growth.

Half As Much At Three Times The Price

In the 10 parish region surrounding New Orleans, the highest export job industry is the 40,000 job tourism industry with an average wage of $32,162 annually. Second on the export job list is the oil & gas industry which is less than half the number of jobs at around 18,000 but with average wages of $109,362. Multiplying the number of jobs by the average wages results in an economic wage total of $1.2 billion for tourism and $1.9 billion for Oil & Gas, a 58% difference. The problem is that of all the export industries since 1980, only four (motion picture, higher education, insurance agencies, and legal services) have increased job growth and the other seven are in a state of decline or stagnation. Oil & gas jobs have been leaving the region since the 1980's, and the same for the shipping industry. Katrina killed our shipbuilding industry but boosted construction and engineering.

10 Parish Region Export Industries Since 1980

Increasing Jobs:

- Motion Picture

- Insurance Agencies

- Higher Education

- Legal Services

Decreasing Jobs:

- Heavy Construction & Engineering

- Tourism

- Oil & Gas

- Shipping

- Ship Building

- Food Manufacturing

Export Industries In 10 Parish Region

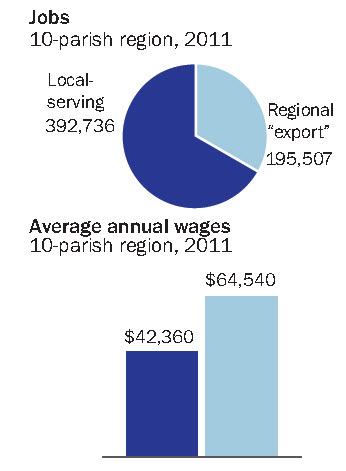

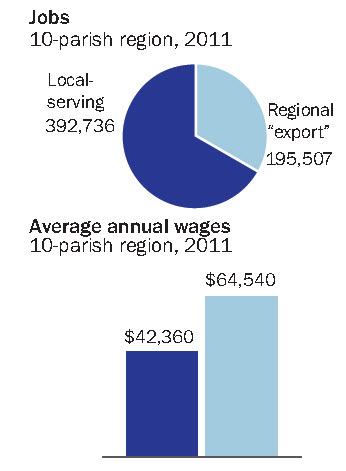

Future Growth Depends On 50 Percent of Jobs

There are 195,507 jobs in the top 10 export industries, compared to 392,736 jobs in other industries, so our future growth depends on 50% of the jobs. The average annual wage of export jobs is $64,540, compared to $42,360 for local jobs. While the future growth may be in the motion picture, higher education, insurance and legal industries, the number of jobs produced still don't surpass ship building. But that is a snapshot of how the economy looks today, and our economy is always evolving and adapting to trends.

Conclusion

One look at the chart above and you can easily determine the downward trends today but also forecast where the job trends might be ten years from now, and it doesn't look good. Looking forward, thank goodness the Louisiana legislature a decade ago passed the Louisiana Motion Picture Act that made the movie industry think of us and thank you to Tulane for spitting out so many lawyers. We will save for later the research on why the insurance industry is growing; but at least we have four great export industries driving growth of the Louisiana economy. If you want to help Louisiana grow, preserve our oil industry and keep churning out petroleum engineering graduates, but also court our motion picture, higher education, insurance and legal industries that could determine our future growth.

Sources: Department of Labor, GNO Inc., The Data Center

Snowden was right. Big data is collecting information on you, but you will be astounded at how the latest technology can help commercial real estate buyers and sellers, landlords and tenants, to not only select the perfect location for their business but reduce advertising expenses and drive sales.

Snowden was right. Big data is collecting information on you, but you will be astounded at how the latest technology can help commercial real estate buyers and sellers, landlords and tenants, to not only select the perfect location for their business but reduce advertising expenses and drive sales.

For example, if your business is selling toothbrushes, we can now tell how much people spend monthly on toothbrushes and toothpaste within a 1, 3 and 5 minute drive time from any location in any town, and compare that to the average across the United States.

The old school strategies include traffic counts and demographics, income and age; the new school strategy is Tapestry Lifestyle Behavior Analysis which drills down into how you think, what your beliefs are, and how you live your life.

Click on the link to the podcast that will explain.

Podcast Presentation: Using The Latest Technology To Find The Perfect Location For Your Business

Technology has taken a giant leap forward in the last few years by expanding the traditional tool of demographic research into an analysis of lifestyles and consumer spending behavior. The old-school strategy was to look at population count, income, and age to determine a good location for a business. But new-school tools such as leakage factor, retail gap, and Tapestry lifestyle analyses take decision making to a higher level and reduce the risk of failure.

Technology has taken a giant leap forward in the last few years by expanding the traditional tool of demographic research into an analysis of lifestyles and consumer spending behavior. The old-school strategy was to look at population count, income, and age to determine a good location for a business. But new-school tools such as leakage factor, retail gap, and Tapestry lifestyle analyses take decision making to a higher level and reduce the risk of failure.

Louisiana Commercial Realty announced today they were hired to market the 69,000 square foot tract of land at 5550 Crowder Boulevard for

Louisiana Commercial Realty announced today they were hired to market the 69,000 square foot tract of land at 5550 Crowder Boulevard for

If you want to see Louisiana grow, which jobs would you prefer to bring in: oil or tourism? One of these two top industries delivers twice as many jobs but has one-third of the wages. This article examines jobs and wages, defining what is called Export Jobs which in the long run determine our economic future.

If you want to see Louisiana grow, which jobs would you prefer to bring in: oil or tourism? One of these two top industries delivers twice as many jobs but has one-third of the wages. This article examines jobs and wages, defining what is called Export Jobs which in the long run determine our economic future.

Snowden was right. Big data is collecting information on you, but you will be astounded at how the latest technology can help commercial real estate buyers and sellers, landlords and tenants, to not only select the perfect location for their business but reduce advertising expenses and drive sales.

Snowden was right. Big data is collecting information on you, but you will be astounded at how the latest technology can help commercial real estate buyers and sellers, landlords and tenants, to not only select the perfect location for their business but reduce advertising expenses and drive sales.